In today’s competitive business landscape, companies must constantly stay up-to-date with their competitor’s strengths and weaknesses to remain relevant and successful.

This article will explore competitive benchmarking, provide some examples, and explain how to conduct a Competitor Benchmarking Report.

What is Competitive Benchmarking?

Competitive benchmarking is an important process that helps us analyze our competitors to identify their strengths and weaknesses. By doing so, we can better understand our position in the market and identify opportunities for improvement.

The ultimate objective of competitive benchmarking is to identify our rivals’ best practices and competitive advantages. These insights can be leveraged to enhance our business strategy and boost our efficiency, productivity, and profitability.

How to Do Competitor Benchmarking Reports

Conducting a Competitor Benchmarking Report involves several steps, including:

Step #1: Identify Competitors

Identifying our direct competitors based on industry, size, and target market is a crucial first step in our competitive benchmarking report.

We won’t cover in detail how to do that in this article. However, every user that creates a free account in Spycrow can request a competitor list. That’s the fastest and most accurate way to identify your competitors without investing money or more than 2 minutes in research. You can sign up in 2 minutes here.

Step #2: Define Metrics

The metrics we consider essential for every business to track are traffic acquisition channels – size, and distribution. There are 5 main traffic channels:

- Direct

- Organic search

- PPC

- Social

- Referral

Knowing the amount and distribution of traffic between these channels for each of our competitors can let us form the big picture of your competitive landscape and give you insights into the strengths and weaknesses of each competitor.

Other important data points that you can include in your benchmarking report can be:

- Reviews and testimonials (avg. rating and amount)

- Price & features

- Social media (followers, activity, engagement)

Step #3: Gather Data

Collecting the data can be tricky, and there are several options. For some metrics, such as reviews and social media followers, we can collect manually every month without investing more than an hour.

On the other side, there are benchmark metrics, such as traffic distribution between channels which can be obtained only through competitor intelligence tools that can provide us with estimations.

The easiest and completely free way to do this is to create an account in Spycrow and add our competitors. The system will generate a report that is automatically updated every month with the new data. This will allow us to consistently gather benchmark data and compare our performance with your competitors. We’ll show examples in the next section of this guide.

Step #4: Analyze Data

Analyze the data to identify trends and areas where your business can improve. The traffic distribution by channels will be extremely useful for that purpose.

Here are some trends and patterns we should be looking at:

- The rapid increase in direct traffic might signal a lot of returning visitors. This means that your competitors are putting effort into returning old users to them. It might also mean a market seasonality. That’s why a month-by-month comparison between competitors is important.

- A strong increase in PPC traffic from multiple competitors might mean that they are taking leverage of existing market seasonality you might not be aware of.

There are limitless cases in which the competitive benchmark analysis can keep us updated and help us not miss big opportunities.

Step #5: Take Action

Develop an action plan that outlines specific steps to implement changes based on the report’s findings.

In the case of rapid direct traffic increase, we want to know how our competitors made their users return. There might be a remarketing display campaign, email campaign, or seasonality that made people return on their own.

In the case of a strong PPC traffic increase, we want to find out which PPC keywords they are targeting and prepare our own campaign.

Conclusion

The competitive benchmark analysis isn’t a magic tool to give us all the answers. However, it is a crucial tool that will tell us where to look and find valuable opportunities. Without it, we’re swimming in the dark, without any idea of what is happening around us and how to take advantage of our surroundings.

Bonus: Competitive Benchmarking Example

Seeing increases or decreases in traffic and conversions for our business means nothing if we don’t look at the big picture.

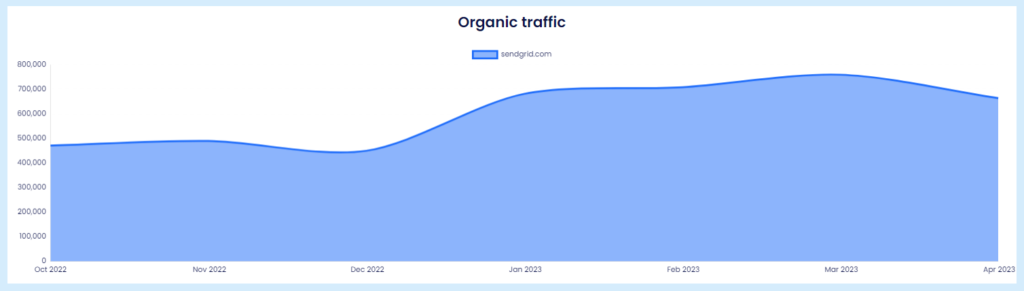

Imagine that you are Sendgrid – an email marketing software, and you are analyzing the organic traffic results at the end of January 2023:

There was a 51% increase in organic traffic in January compared to December. Our first thought might be that this is great. We did something right to achieve such tremendous growth, right? WRONG!

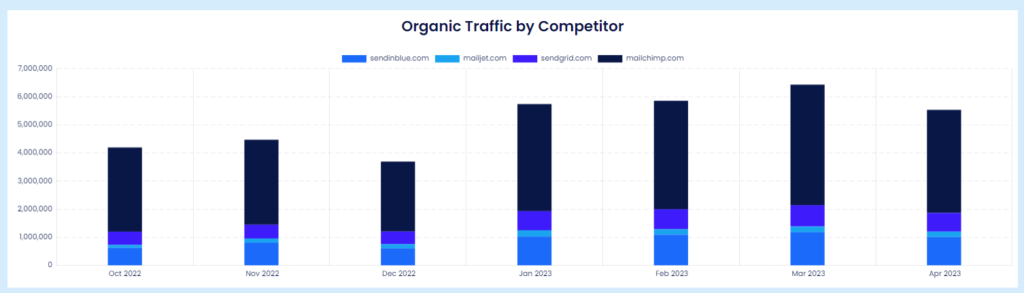

When we look at the comparison with our competitors, we see that this growth in organic traffic is a result of seasonality and a pattern that affected all companies in the industry:

In fact, most of our competitors outperformed us and achieved much higher growth in organic traffic.

That’s just an example of how analyzing only our own results can lead to serious misinformation and wrong decisions.

How to access the data about our competitors?

The only way to access such benchmark data is through competitor intelligence platforms. In Spycrow, you can do most of it with our Free plan, which includes competitor comparison for all traffic channels and historical data for Direct traffic. You can sign up here.